Social Security Withholding Percentage 2025 - More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi). The amount of earnings required in order to be credited with a. Up to 85% of your social security benefits are taxable if:

More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi).

Social Security Withholding Percentage 2025. (thus, the most an individual employee. / updated december 06, 2023.

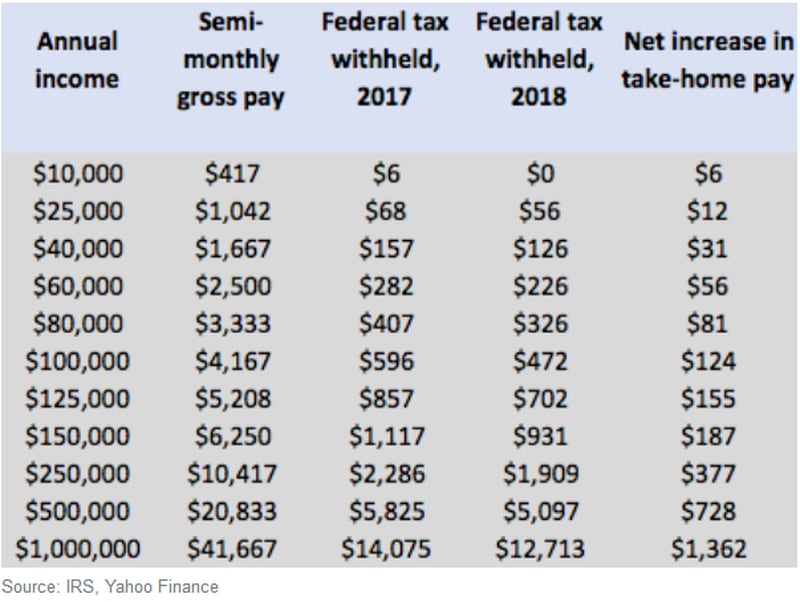

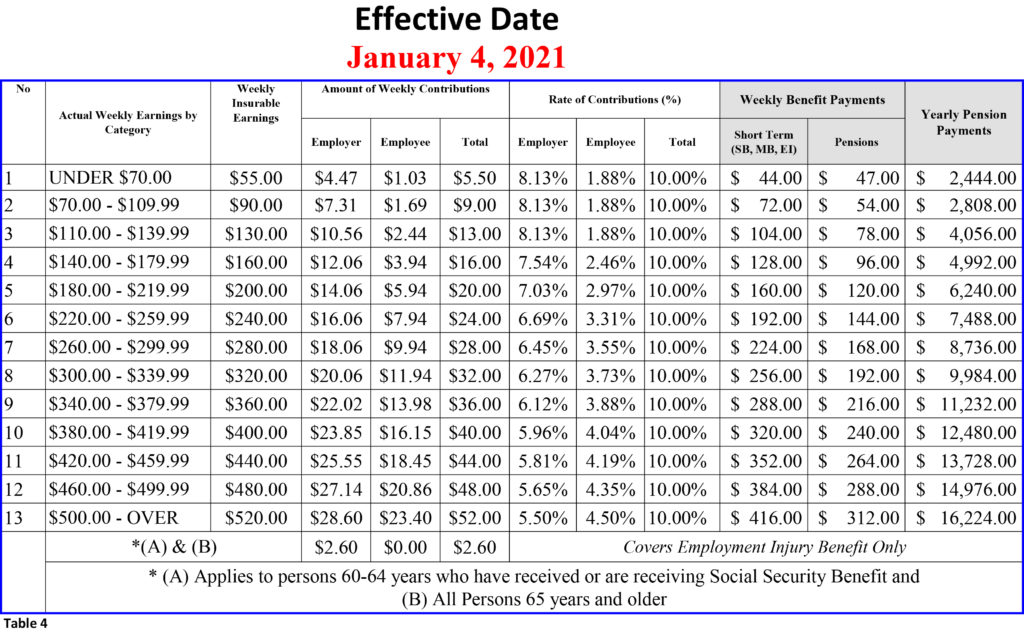

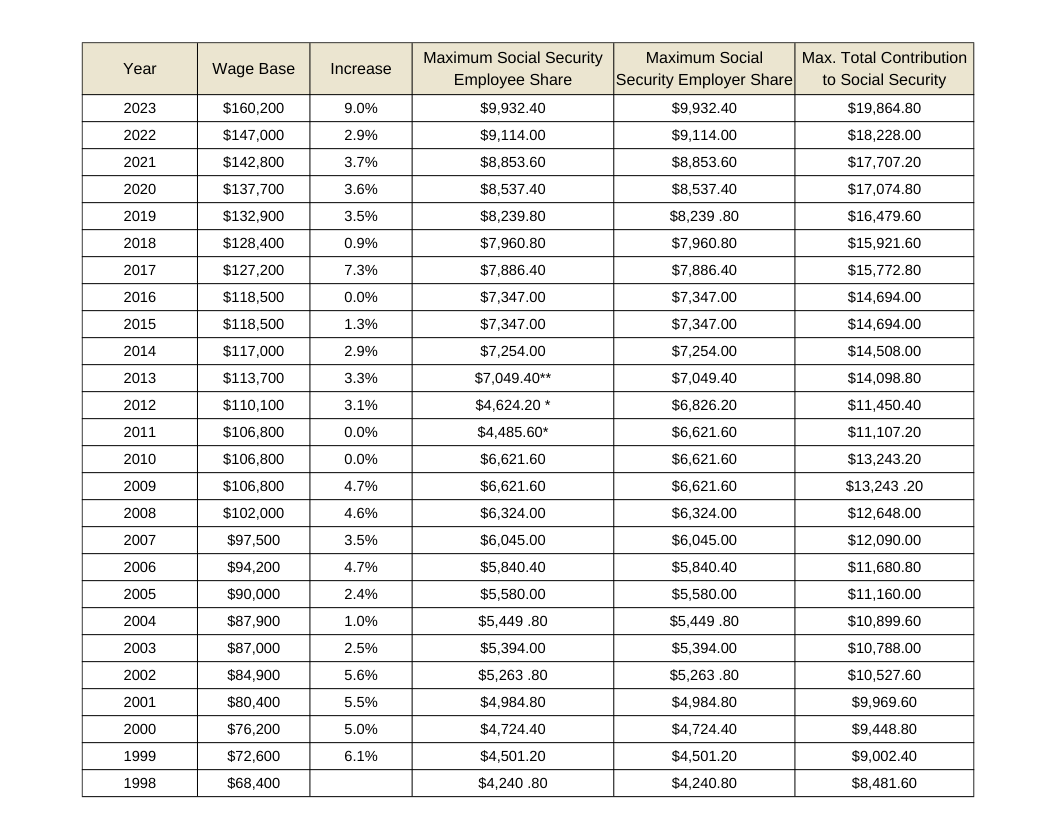

Limit For Maximum Social Security Tax 2025 Financial Samurai, When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld. The law requires employers to withhold a certain percentage of an employee’s wages to help fund social security and medicare.

Limit For Maximum Social Security Tax 2025 Financial Samurai, Social security and supplemental security income (ssi) benefits will increase by 3.2% in 2025. The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2023 wage base of.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

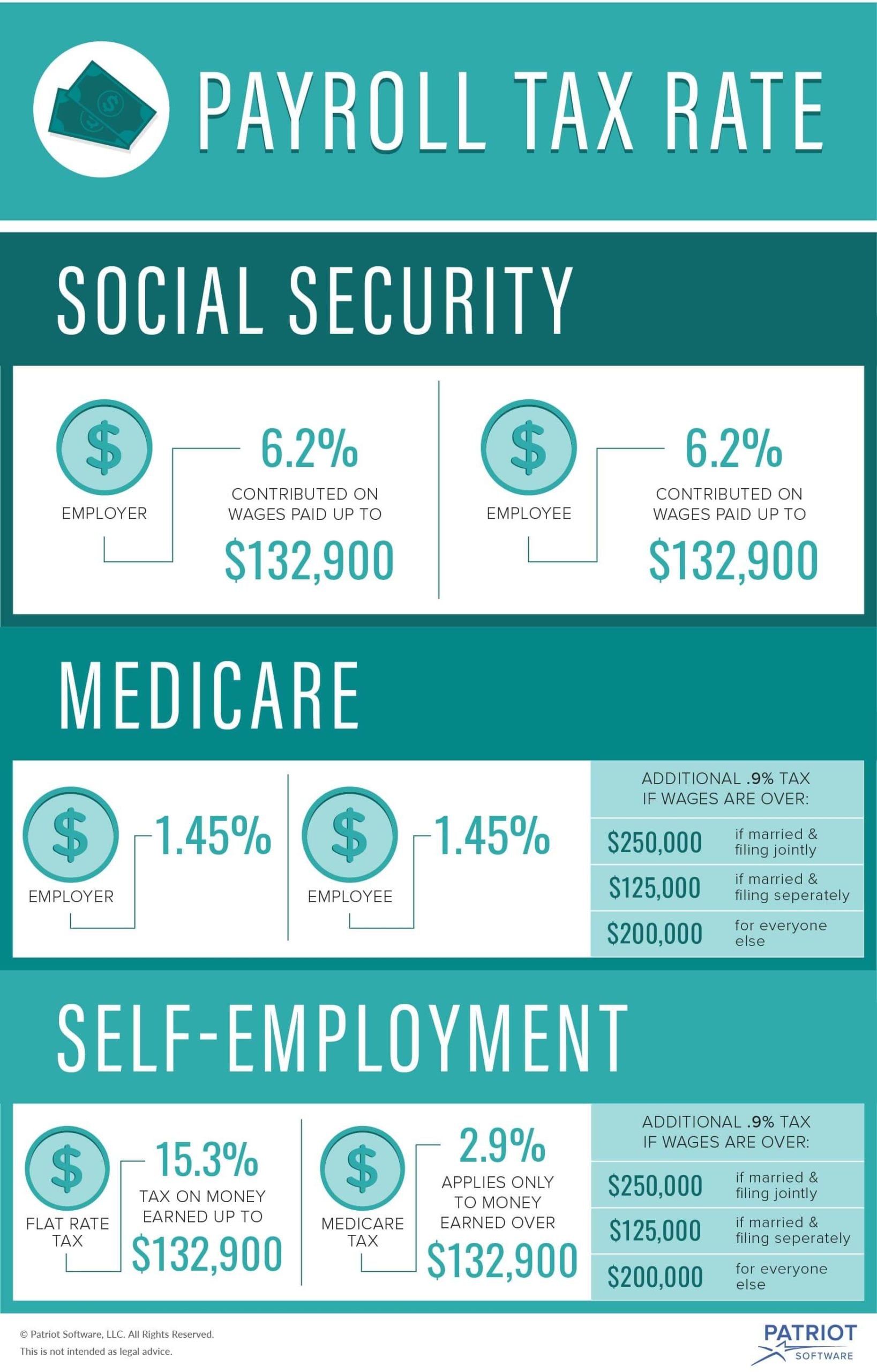

What should employers know about social security tax?

What Is The Social Security And Medicare Tax Rate, The law requires employers to withhold a certain percentage of an employee’s wages to help fund social security and medicare. The social security tax limit refers to the maximum amount of earnings that are subject to social security tax.

More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi).

Here's why there's more money in your paycheck, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. If you start collecting social security before full retirement age, you can earn up to $1,860 per month ($22,320 per year) in 2025 before the ssa will start withholding.

If you will reach fra in 2025, social security withholds $1 in benefits for every $3 in earnings above $59,520 (up from $56,520 in 2023) until the month when you.

Es Seguro Viajar A Nicaragua 2025. Nicaragua es un país relativamente seguro para viajar, aunque […]

How To Calculate, Find Social Security Tax Withholding Social, The hi (medicare) is rate is set at 1.45% and. More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi).